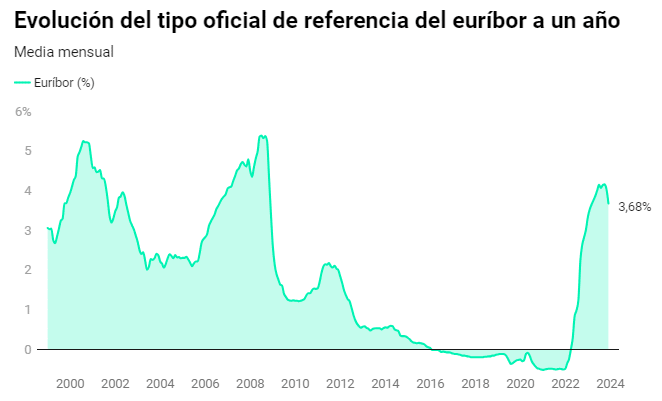

If you have a mortgage in Spain, you are probably familiar with the Euribor index, which is the main reference for most variable-rate loans. The Euribor is the average interest rate at which banks lend to each other in the eurozone, and it reflects the monetary policy of the European Central Bank (ECB).

The Euribor has been fluctuating in recent years, reaching negative values in 2016 and staying below zero until 2022. However, since then, it has been rising steadily, reaching positive territory in 2023 and hitting a peak of 4.16% in October .

But in December 2023, the Euribor experienced a sharp drop, closing the month at 3.679%, which is 0.343 points lower than in November . This means that mortgages linked to the Euribor will see their monthly payments decrease slightly in January 2024, when the new rate is applied.

What caused this sudden fall in the Euribor? And what can we expect for the next year?

The main reason behind the decline of the Euribor in December was the announcement of the ECB to reduce its bond-buying program, known as PEPP (Pandemic Emergency Purchase Programme), from 80 billion euros per month to 60 billion euros starting from January 2024 . This decision signaled that the ECB is confident that the economic recovery in the eurozone is on track.

The reduction of the PEPP implies that there will be less liquidity in the financial system, which tends to push interest rates up. However, the ECB also clarified that it will keep its main refinancing rate at 0%, and that it will continue to provide cheap loans to banks through its TLTROs (Targeted Longer-Term Refinancing Operations) until at least June 2024 . These measures are intended to support lending and investment in the real economy, and to prevent a premature tightening of financial conditions.

Therefore, the market interpreted that the ECB is adopting a cautious and gradual approach to normalize its monetary policy, and that it will not raise its key interest rate until inflation is durably close to its target of 2%. As a result, the expectations of future rate hikes by the ECB were revised downwards, which led to a lower Euribor.

Looking ahead, the evolution of the Euribor in 2024 will depend largely on how inflation behaves, and how the ECB reacts.

At Asufin they are optimistic and their forecast for the one-year Euribor in 2024 is that it will be 3.30% in March, 3.00% in June, 2.80% in September and 2.60% in December.

Of course, these projections are subject to a high degree of uncertainty and volatility, and they could change significantly depending on new developments. Therefore, if you have a mortgage linked to the Euribor, it is advisable to keep an eye on its monthly fluctuations and to plan your budget accordingly.

If you are planning to buy a property on the Costa del Sol this coming year, contact us and our team will be happy to advise you and help you find the home of your dreams.