Luxury Real Estate Investment 2025 Trends in Marbella, Estepona & Benahavís

The Costa del Sol continues to attract discerning investors from around the world. In 2025, Spain’s Golden Triangle, Marbella, Estepona and Benahavís, stands out as one of Europe’s most resilient luxury property markets. Prices have reached record highs, yet demand remains strong, driven by international buyers, limited supply, and an unparalleled Mediterranean lifestyle.

Market Overview: Resilient Growth and Record Prices

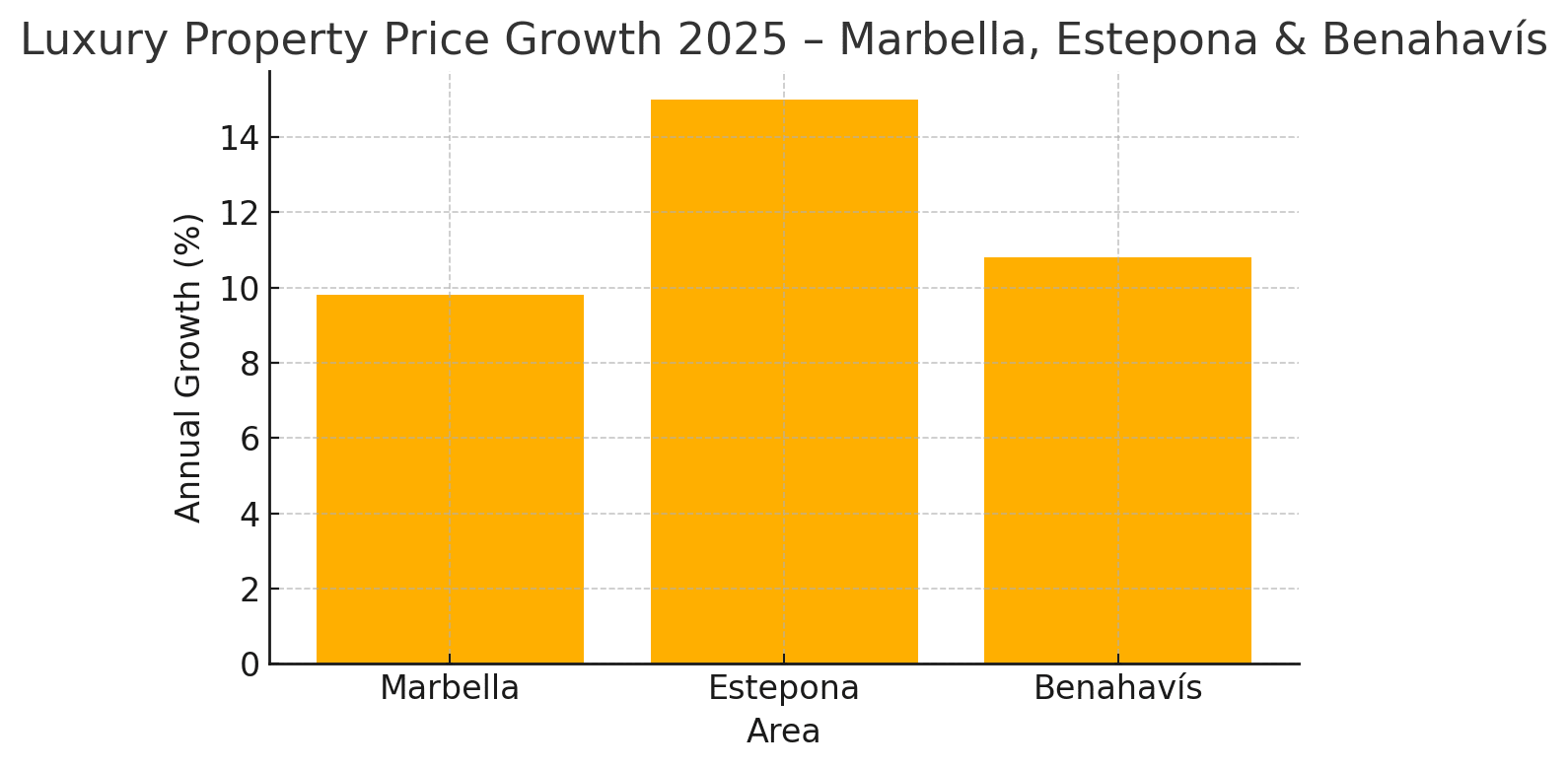

Luxury property prices across the Golden Triangle have increased by an average of 12% year-on-year, led by Estepona (+15%), Benahavís (+10.8%) and Marbella (+9.8%) Source: Cadena Ser

This steady growth reflects two key dynamics:

- A shortage of premium beachfront properties, particularly in developments such as Cabo Bermejo, Torre Bermeja, and Las Dunas Park.

- Strong international demand from northern Europe and the Middle East for turnkey, fully serviced residences.

Source: Livingstone Estates Market Analysis, Q3 2025.

Prime Price Benchmarks and Market Segmentation

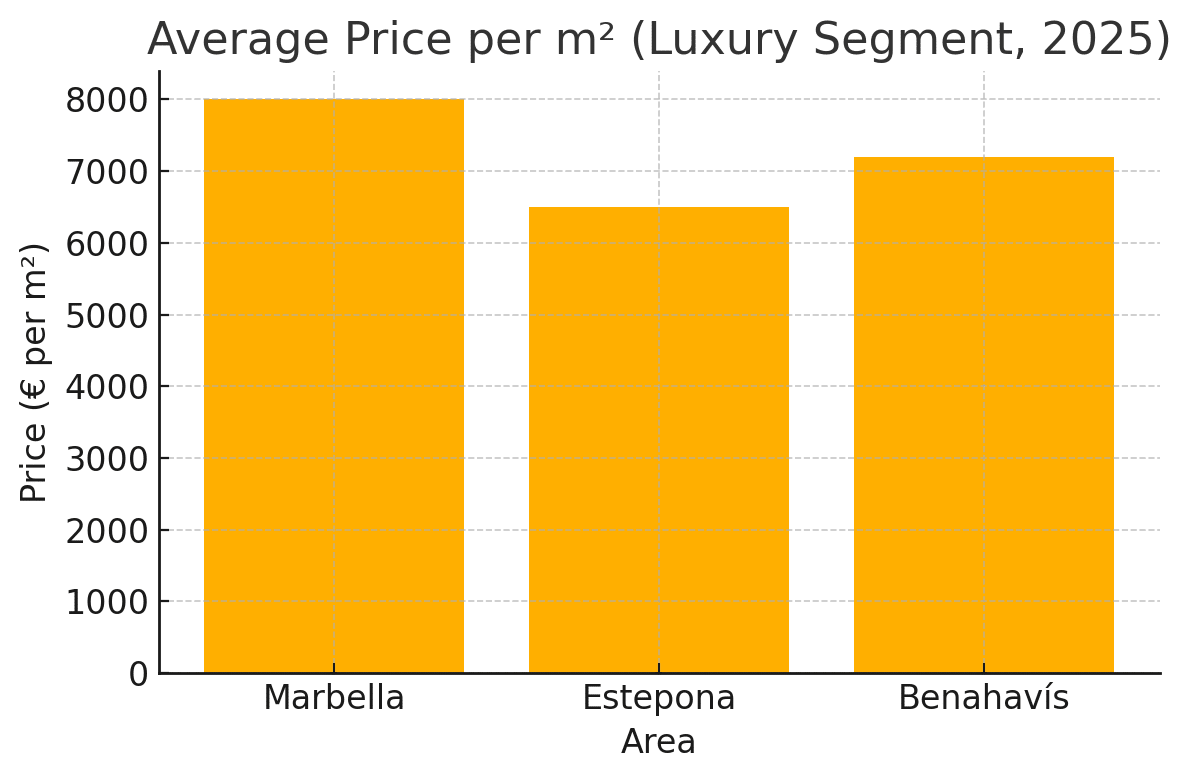

Average luxury property prices now range from €6,000 to €14,000 per m², depending on location, view, and quality. Marbella remains the benchmark for ultra-prime residences, while Estepona’s New Golden Mile has become a standout investment zone.

- Marbella: approximately €8,000/m² for newly built or fully renovated villas.

- Estepona: approximately €6,500/m² with excellent potential for capital growth.

- Benahavís: approximately €7,200/m², led by private estates and golf-view villas.

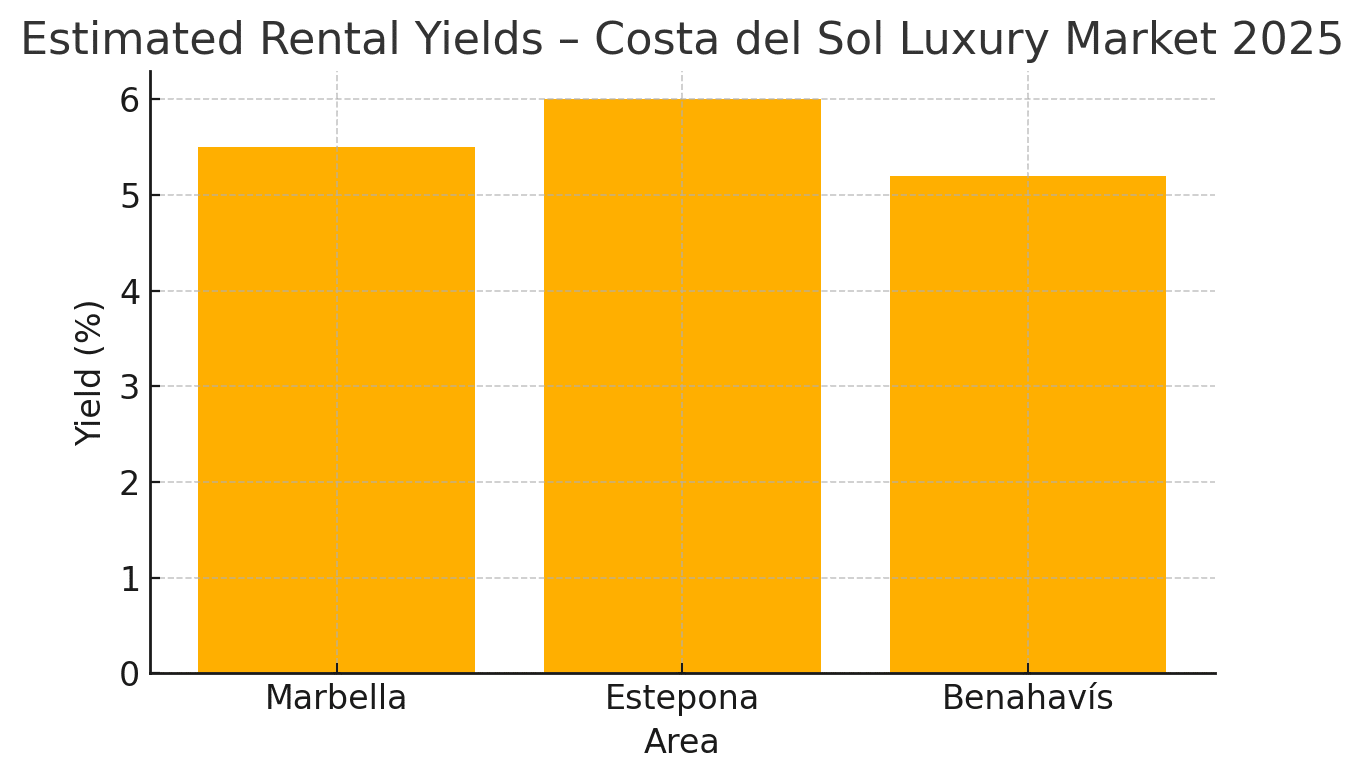

Rental Returns and Investor Outlook

The Costa del Sol continues to outperform other European destinations thanks to its robust year-round rental market. Estepona currently offers the highest luxury rental yield at around 6%, with Marbella and Benahavís averaging between 5% and 5.5%. Investors prioritising energy-efficient, prime-located assets can expect stable income streams and sustained capital appreciation.

Key Investment Drivers for 2025–2026

- Limited supply: a restricted pipeline of new projects supports price growth.

- Sustainability and smart-home technology: buyers increasingly demand energy-efficient, automated properties.

- Lifestyle appeal: proximity to golf, marinas, and international schools adds investment value.

- Design trends: Mediterranean minimalism, open layouts, and natural finishes dominate new developments.

Strategic Investment 2025 Takeaways

- Buy quality, not hype: prioritise location, sea views, build quality, and sustainability.

- Reposition and renovate: upgrading second-line homes can add 15–25% to resale value.

- Timing: properties listed since early summer 2025 may offer better negotiation opportunities as transaction volumes normalise.

- Diversify: combine a core beachfront property with a value-add renovation for a balanced portfolio.

Where to Invest Now

These developments remain among the most prestigious addresses on Estepona’s New Golden Mile, exclusively represented by Livingstone Estates:

Emerging Hotspots on the Costa del Sol

Beyond the established beachfront enclaves of the New Golden Mile, several areas across Estepona and Benahavís are attracting growing interest from international buyers. These locations combine modern infrastructure, strong value potential and proximity to the coast, golf and leisure amenities — making them increasingly desirable for both investors and end-users.

- El Paraíso (Benahavís) – Average prices currently stand at approximately €4,682 per m² (2025), reflecting a 7.2% annual increase. The wider El Paraíso–Atalaya–Benamara corridor has reached roughly €4,326 per m² (+10% year-on-year), confirming sustained market activity in this sought-after residential zone.

- La Resina Golf & Country Club (Estepona East) – Average prices for houses are around €4,111 per m² and for apartments €4,399 per m² (2025). Selected new-build units achieve €5,900 per m², highlighting the premium commanded by contemporary design and energy efficiency.

- Atalaya Isdabe (Estepona West) – Average values are close to €4,682 per m² in 2025. This area offers excellent value compared with frontline developments, appealing to families and investors seeking modern homes near international schools and golf courses.

- Los Flamingos Golf (near Benahavís) – Villas here average €4,049 per m², with overall asking prices surpassing €4.3 million. The combination of panoramic sea views, five-star golf and gated security keeps this resort among the most coveted addresses on the western Costa del Sol.

- Guadalmansa Beach (Estepona East) – One of the most desirable new beachfront areas, with prices reaching approximately €7,500 per m² — an increase of around 50% over five years. High rental demand and limited supply reinforce its reputation as a top-performing investment micro-market.

Together, these emerging zones illustrate how the Costa del Sol’s luxury property landscape is evolving. Buyers are increasingly looking beyond traditional beachfront developments, seeking contemporary architecture, sustainability and lifestyle-driven value in areas that promise both comfort and long-term capital appreciation.

Conclusion

In 2025, the Costa del Sol’s luxury property sector stands as one of Europe’s most secure long-term investments. Limited new supply, consistent international demand, and an unrivalled lifestyle continue to make the Golden Triangle a focal point for both capital preservation and growth.

Register today to our Guadalmansa Insider Newsletter and get all the latest updates & news about the Guadalmansa area in your inbox.

Contact

If you would like help improving your return on investment under the new rules, contact our team or call +34 952 806 417 for tailored, straightforward guidance.

Livingstone Estates – Luxury Real Estate on the New Golden Mile

Phone: +34 952 806 417

Email: info@livingstone-estates.com

Website: www.livingstone-estates.com

Image genereated with AI Gemini