Livingstone Estates presents an updated real estate property market report for the beginning of 2026, analysing residential sales and rental trends in Spain, with a specific focus on Estepona, Marbella, and Benahavís. This report uses publicly available market index (Idealista) and prime-area benchmarks (Tecnitasa), combined with local, on-the-ground segmentation to identify emerging tendencies and areas of strongest demand.

Spain Property Market at the Start of 2026: Prime Prices Set the Tone

Spain’s property market continues to show upward pressure in 2026, particularly in premium locations where supply is limited and demand remains resilient. Tecnitasa’s 2026 prime-area benchmark highlights the continued expansion of top price bands:

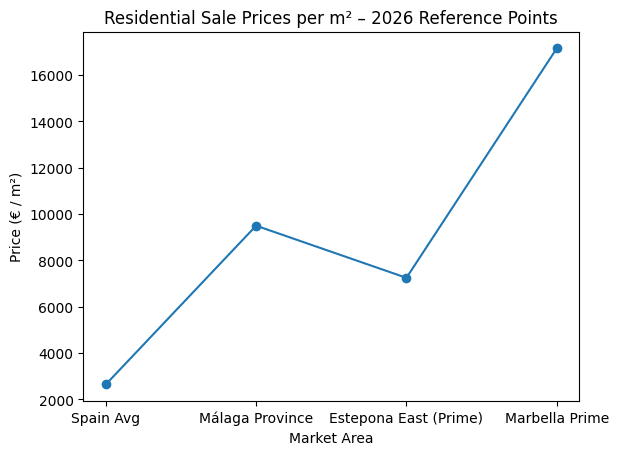

- Nine Spanish cities now exceed €6,000/m² in prime zones, a milestone that reflects both scarcity and demand concentration.

- Madrid (Recoletos) leads with prime values reaching €20,500/m².

- Marbella (Puente Romano) is among the highest prime markets in Spain at €17,150/m², reinforcing its position as an international luxury benchmark.

- Other notable prime references include Barcelona (Paseo de Gracia) at €10,900/m² and Málaga city prime zones at €9,500/m².

Beyond prime districts, Tecnitasa also notes that price pressure is not limited to luxury enclaves: “minimum” price levels are rising too, driven by limited available stock in the most demanded markets and displacement of demand toward nearby areas.

Spain Rental Market at the Start of 2026: Rising Rents and Persistent Supply Shortage

Figures shown are reference benchmarks based on publicly available market indices (Idealista, Tecnitasa) and are provided for illustrative purposes only.

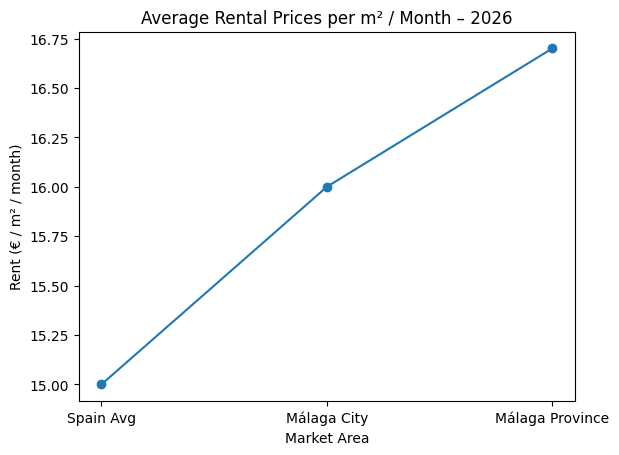

The rental property market remains one of the most important drivers of household decisions and investment appetite. According to Idealista’s January 2026 rental index:

- National rents increased 8.1% year-on-year, with a national average of €15/m².

- In the last 3 months, rents rose 3.4%, and 1.7% month-on-month, signalling persistent short-term pressure.

- Among major cities, Málaga city stands at €16/m², while the province of Málaga averages €16.7/m².

For the Costa del Sol, these rental dynamics matter because rising rents often translate into: (1) stronger landlord pricing power for well-located homes, and (2) faster decision-making among lifestyle buyers who prefer ownership when long-term rental supply is scarce.

How Spain-Wide Trends Translate to the Costa del Sol

At the local level, the Costa del Sol behaves differently from many Spanish inland property markets due to international lifestyle demand, limited coastal land, and strong year-round services. The 2026 pattern remains consistent: prime beachfront, gated communities, and turn-key renovated homes are the most liquid segments, while older stock without upgrades is more price-sensitive.

Figures shown are reference benchmarks based on publicly available market indices (Idealista, Tecnitasa) and are provided for illustrative purposes only.

Estepona East: The Core Growth Corridor for Lifestyle Buyers and Investors

Estepona East continues to attract a broad buyer profile seeking coastal lifestyle, modernised housing stock, and proximity to Marbella—while maintaining a more residential feel. You can explore our current portfolio here:

Luxury properties for sale in Estepona East

Demand remains strongest for established beachfront communities with proven track record, quality construction, and on-site services. Key examples include:

Within the most consolidated beachfront stretch of Estepona East (Guadalmansa and immediate surroundings), market references commonly sit in the €7,000–€7,500/m² range for prime-quality beachfront product, with pricing highly dependent on exact frontage, views, and renovation level.

Emerging and Expanding Areas Around Estepona East

In parallel to prime beachfront demand, we continue to see growing attention toward well-connected areas that offer newer housing stock, stronger value positioning, and easier entry points compared to frontline beach communities.

- Cancelada: increasingly popular for modern apartment developments and proximity to both Estepona and Marbella. See current options: Properties for sale in Cancelada.

- Other Estepona East sub-areas gaining visibility include zones with newer builds and improved services where buyers prioritise “modern, lock-up-and-leave” living over beachfront frontage.

- Selwo: A Key Residential Growth Area in Estepona East

Selwo has become one of the most active residential submarkets in Estepona East, largely driven by the concentration of new developments delivered between 2019 and 2026.

The area appeals primarily to buyers and tenants seeking modern, low-maintenance properties rather than beachfront positioning. Demand is strongest for newly built apartments and gated communities with communal facilities.

- Property profile: Modern apartments and penthouses in residential complexes

- Buyer type: Second-home buyers, relocations, and value-focused investors

- Price positioning: Below beachfront Estepona East, but above inland Estepona West

- Rental performance: Particularly strong for mid-term and long-term rentals

Selwo’s role in the property market reflects a broader 2026 tendency: as prime beachfront supply remains limited, demand continues to expand into well-connected residential zones offering newer construction and stronger rental flexibility.

View available properties here: Properties for sale in Selwo.

The broader tendency is clear: when prime beachfront supply is tight, demand spreads to nearby areas that still offer quality living and strong rental fundamentals.

Marbella: Prime Benchmark for Luxury Pricing

Marbella remains the reference point for Spain’s luxury segment, reinforced by Tecnitasa’s prime benchmark of €17,150/m² in Puente Romano. This matters for the wider region because Marbella’s top pricing often “pulls” demand along the coast—supporting price floors and liquidity in adjacent premium corridors such as Estepona East.

Benahavís: Space, Privacy and Resort-Style Living

Benahavís continues to attract buyers seeking privacy, views, and resort-style living—particularly around golf and gated communities. The property market tends to be more lifestyle-driven, with strong demand for villas and high-quality apartments in established resorts, and steady interest in well-positioned new-build or renovated homes.

Rental Market Trends on the Costa del Sol: What Is Changing in 2026

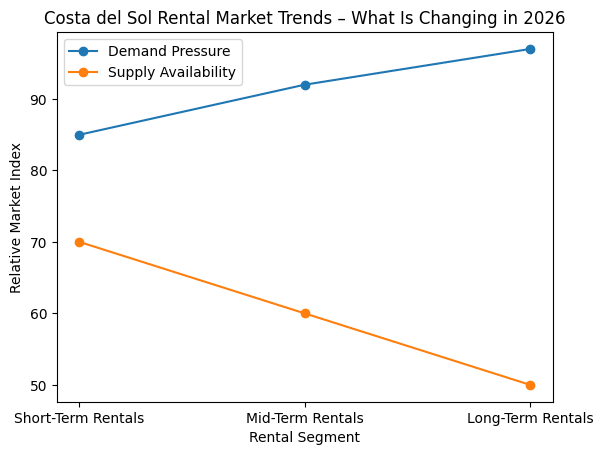

Relative comparison of demand pressure and supply availability across rental segments on the Costa del Sol in 2026. Long-term and mid-term rentals show the strongest structural imbalance.

Chart based on market observation and publicly available data (Idealista). Values are indicative and used for comparative illustration.

Rental demand remains robust across the Costa del Sol, but the market is increasingly segmented:

- Long-term rentals (12+ months): structurally limited supply for quality homes, supporting rent increases and faster tenant decision cycles.

- Mid-term rentals (3–11 months): a growing segment driven by remote workers, relocations, and extended seasonal stays.

- Short-term rentals: concentrated in prime coastal and resort locations, highly sensitive to quality, furnishing, and proximity to amenities.

For landlords and owners, professional management and positioning (presentation, furnishing standard, pricing strategy, compliance) has become more important as competition rises in the mid-market, while prime beachfront remains relatively supply constrained.

Explore Livingstone rentals and services here:

New Developments: Where Demand Is Going

New developments remain one of the most visible indicators of market direction in 2026. Buyers are increasingly drawn to new-build and off-plan product when it offers:

- Energy efficiency and contemporary specifications

- Gated communities with amenities (security, gym, pools, gardens)

- Strong terraces/outdoor living and modern layouts

- Low-maintenance “lock-up-and-leave” ownership for international clients

In Estepona and surrounding areas, new development supply is expanding, but well-located projects continue to absorb strongly—particularly where they offer the right balance of connectivity, design, and lifestyle infrastructure.

Conclusion: Key Tendencies to Watch Through 2026

- Prime benchmarks are rising nationally, with Marbella confirming its position among Spain’s top luxury locations.

- Rental pressure remains structural across Spain, with Málaga province among the most expensive provincial rental markets.

- Estepona East continues to lead local demand for gated beachfront living and high-quality lifestyle property.

- Demand is widening to well-connected neighbouring areas such as Cancelada as buyers seek newer builds and better entry points.

- New developments remain a key signal of demand for modern, efficient, amenity-rich homes.

Sources:

- Idealista – House Price Index (Spain): idealista.com

- Idealista – Rental Price Index (Spain): idealista.com

- Idealista – Málaga Province Housing Prices: idealista.com

- Banco de España – Real Estate Market Statistics: bde.es

- Instituto Nacional de Estadística (INE) – Housing Data: ine.es

- Tecnitasa – Residential Valuation Benchmarks: tecnitasa.es

- Livingstone Estates internal Market Observations

Contact Livingstone Estates

For guidance aligned with your objectives—whether purchasing, selling, or renting—please contact Livingstone Estates:

- Email: info@livingstone-estates.com

- Phone: +34 952 806 417

- Office: Urb. Guadalmansa, Edif. Salinas Local 7, Estepona

Register today to our Guadalmansa Insider Newsletter and get all the latest updates & news about the Guadalmansa area in your inbox.

This article is provided for general market information only and does not constitute legal, tax, or investment advice.